Does Defensive Driving Course Reduce Insurance

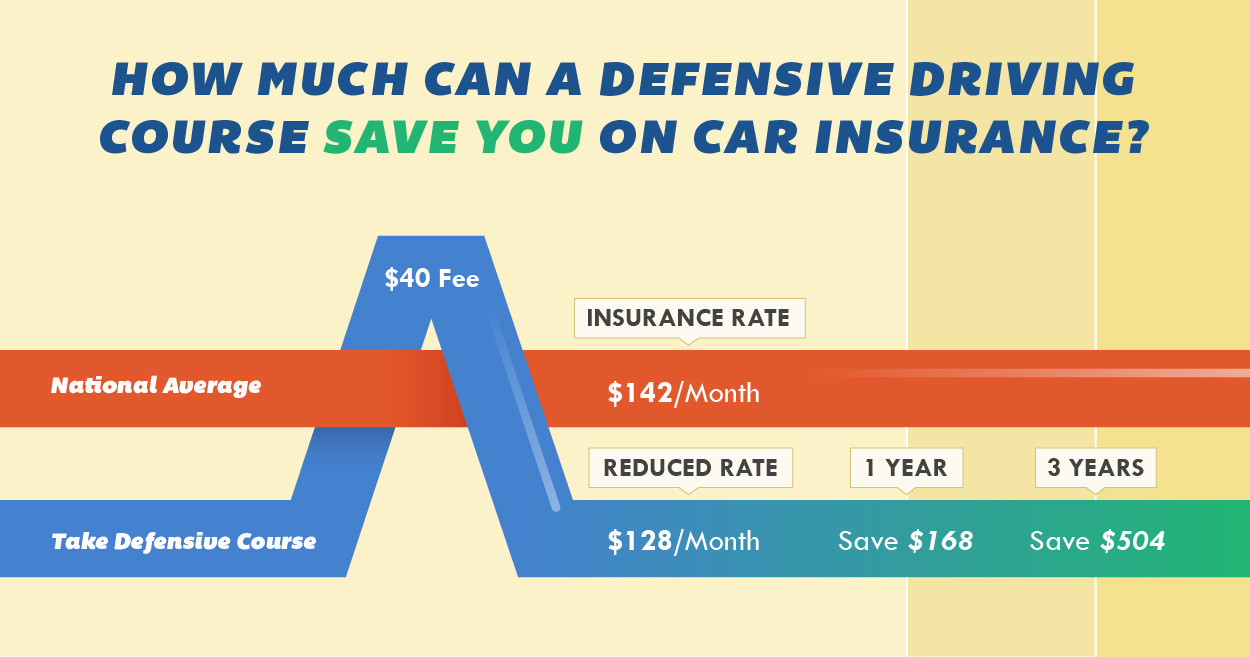

Does Defensive Driving Course Reduce Insurance - It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. Completing a defensive driving course can lead to significant savings on your auto insurance premiums. Learn about essential defensive driving techniques, how. Young drivers can often save money by completing an approved driver training (or driver's education) course, while older drivers are often offered a discount for defensive driving training. If you enroll in and complete a defensive driving course with a traffic safety school, you can avoid a conviction on your driving record, and your insurance rates will not increase. The answer is that it. So, does defensive driving lower insurance? Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Beyond savings, the course equips you with. Completing a defensive driving course can help you save on auto insurance if your insurer offers a defensive driver discount. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. The actual amount of the discount will vary based on your insurer,. To qualify for a defensive driver car. Our 100% online course is approved by the texas department of. The discount varies but usually falls in the range of 5% to 20% off your. Young drivers can often save money by completing an approved driver training (or driver's education) course, while older drivers are often offered a discount for defensive driving training. These programs are a great. So, does defensive driving lower insurance? Completing a defensive driving course can lead to significant savings on your auto insurance premiums. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. Get your texas defensive driving course done fast to dismiss a traffic ticket or earn an insurance discount! Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. These programs are typically offered online or in. The actual amount of the discount will vary based on your insurer,. We always recommend checking with your insurance provider to confirm the discount you can. To qualify for a defensive driver car. If you enroll in and complete a defensive driving course with a traffic safety school, you can avoid a conviction on your driving record, and your insurance. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Not only does defensive driving help you stay safe, but it may also save you. Learn about essential defensive driving techniques, how. Our 100% online course is approved by the texas department of. Drivers can typically save between 5%. One of the most apparent options for conserving a little bit of cash is by lowering monthly car insurance rates. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums.. If you enroll in and complete a defensive driving course with a traffic safety school, you can avoid a conviction on your driving record, and your insurance rates will not increase. Completing a defensive driving course can help you save on auto insurance if your insurer offers a defensive driver discount. Completing a defensive driving course can lead to significant. Our 100% online course is approved by the texas department of. So, does defensive driving lower insurance? Get your texas defensive driving course done fast to dismiss a traffic ticket or earn an insurance discount! These programs are typically offered online or in person. These programs are a great. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. The actual amount of the discount will vary based on your insurer,. Our 100% online course is approved by the texas department of. These programs are typically offered online or in person. Young. Qualify for a defensive driving discount on car insurance; Young drivers can often save money by completing an approved driver training (or driver's education) course, while older drivers are often offered a discount for defensive driving training. Not only does defensive driving help you stay safe, but it may also save you. Many insurance providers offer significant reductions on your. These programs are a great. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. Learn how to get a defensive driver auto insurance. Young drivers can often save money by completing an approved driver training (or driver's education) course, while older drivers are often offered a discount for defensive driving training. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Get your texas defensive driving course done fast to dismiss a traffic ticket or earn an insurance. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. The discount varies but usually falls in the range of 5% to 20% off your. We always recommend checking with your insurance provider to confirm the discount you can. If you enroll in and complete a defensive driving course with a traffic safety school, you can avoid a conviction on your driving record, and your insurance rates will not increase. Qualify for a defensive driving discount on car insurance; Our 100% online course is approved by the texas department of. To qualify for a defensive driver car. Beyond savings, the course equips you with. One of the most apparent options for conserving a little bit of cash is by lowering monthly car insurance rates. Completing a defensive driving course can lead to significant savings on your auto insurance premiums. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Many insurance providers offer significant reductions on your premium if you complete a defensive driving course. Some states require insurance companies to offer a. Learn about essential defensive driving techniques, how. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. A defensive driving course typically lasts six to eight hours.Can Defensive Driving Training Lower Your Car Insurance

Does Taking a Defensive Driving Course Lower Insurance?

Are Defensive Driving Courses Worth the Money? QuoteWizard

Defensive Driving Course for Automobile Insurance Reduction/Point

Defensive Driving Course Remedial Improved Driving Program

Does a defensive driving course lower your insurance costs?

How Much Does a Defensive Driving Course Save on Insurance?

Car Insurance Startup Changing Home, Life, Auto, & Business Policies

Does a defensive driving course lower your insurance costs?

Defensive Driving Course Lower Insurance Remove Points Ferrari

Young Drivers Can Often Save Money By Completing An Approved Driver Training (Or Driver's Education) Course, While Older Drivers Are Often Offered A Discount For Defensive Driving Training.

These Programs Are Typically Offered Online Or In Person.

Reduce The Likelihood Of A Crash Or Incident;

So, Does Defensive Driving Lower Insurance?

Related Post: