E Mini Futures Trading Courses

E Mini Futures Trading Courses - Learn about the benefits of futures including margin & capital efficiency, tax considerations, and market liquidity. Sign up for a free emini s&p futures course to receive education on this future product. Education is one of the most important components to your success as a trader at apexfutures. If you have carried out research or seen posts online that point to the price of oil rising, one way to take a long position in the market is to buy an oil future. Of course, trading is difficult. As the price of a future is derived from the price of an underlying asset, should the oil price rise, the price of oil futures will rise as well.of course, should the price of oil fall, the p&l on. With our extensive library of webcasts available 24/7, you can learn about the topics you want, when you want. Whether your trading end of day or in real time, it’s all about mastering how to trade in the same direction as the smart money. Here's how anyone can start and profit. How does futures trading work? You will also be taught risk mitigation trading strategies and how to increase profitability while maintaining acceptable known risk. That includes the following markets: It gives you the tools you need to trade not just one market, but several markets, if you wish! Fortunes can be made by. These contracts obligate the buyer to buy and the seller to sell, even if the price goes against the trade. How does futures trading work? If you have carried out research or seen posts online that point to the price of oil rising, one way to take a long position in the market is to buy an oil future. In this course, you’ll learn how to set your futures charts margin requirements, understand the cot report, indicators, and the most popular trading strategies, and prepare for live futures trading action. Whether your trading end of day or in real time, it’s all about mastering how to trade in the same direction as the smart money. Here's how anyone can start and profit. Futures contracts lock in the current price of a commodity or stock and define the current fixed cost of the underlying asset and its expiry date. These contracts obligate the buyer to buy and the seller to sell, even if the price goes against the trade. The similarities and differences between futures and etfs. Futures trading can be an effective. It requires discipline and risk capital. That includes the following markets: Here's how anyone can start and profit. We will build your foundations by showing you the ninjatrader platform and how to use every component to make you comfortable navigating it all by yourself. Education is one of the most important components to your success as a trader at apexfutures. Mini futures mini futures have differing contact sizes based on the contract multiplier. This system adds a whole new dimension to day trading the emini markets. It gives you the tools you need to trade not just one market, but several markets, if you wish! In part 1 of the emini day trading series we will look at what emini. Enroll in the course to learn the most important aspects of emini trading, including actual examples of trading situations. That includes the following markets: Oh, and some of the lowest futures commissions on the market, educational courses and advanced trading tools across its different trading platforms. We also look at some of the important details like the value of ticks. Yes, with the right approach and skill development. Education is one of the most important components to your success as a trader at apexfutures. Fortunes can be made by. Price charts for study which can be found free online. As futures are leveraged, trades can become very profitable or incur a significant loss.leverage means traders do not have to. In part 1 of the emini day trading series we will look at what emini s&p 500 (es) futures actually are, including a brief history on how this instrument was created. The similarities and differences between futures and etfs. If you have carried out research or seen posts online that point to the price of oil rising, one way to. With our extensive library of webcasts available 24/7, you can learn about the topics you want, when you want. How does futures trading work? Education is one of the most important components to your success as a trader at apexfutures. Sign up for a free emini s&p futures course to receive education on this future product. In this trading course. If you have carried out research or seen posts online that point to the price of oil rising, one way to take a long position in the market is to buy an oil future. Fortunes can be made by. That includes the following markets: It requires discipline and risk capital. Learn about the benefits of futures including margin & capital. It requires discipline and risk capital. Mini futures mini futures have differing contact sizes based on the contract multiplier. Futures contracts lock in the current price of a commodity or stock and define the current fixed cost of the underlying asset and its expiry date. How does futures trading work? Futures contracts often require margin deposits that can be prohibitive. Connect with a member of our expert equity team for more information about our products. Education is one of the most important components to your success as a trader at apexfutures. Get emini future trading education with apexfutures. Oh, and some of the lowest futures commissions on the market, educational courses and advanced trading tools across its different trading platforms.. We also look at some of the important details like the value of ticks and points when price moves, contract expirations, and the times that the market is open and highly active. Emini trading authority offers a variety of emini futures trading courses designed to help you achieve your trading goals, regardless of your experience level. Enroll in the course to learn the most important aspects of emini trading, including actual examples of trading situations. That includes the following markets: This system adds a whole new dimension to day trading the emini markets. Oh, and some of the lowest futures commissions on the market, educational courses and advanced trading tools across its different trading platforms. You will also be taught risk mitigation trading strategies and how to increase profitability while maintaining acceptable known risk. Our online futures trading course is designed to teach you the skills to become an independent futures trader. Best online stock market trading courses for a fee. Register for our free emini futures course. Benefits and drawbacks of futures prop trading firms 1. Of course, trading is difficult. Futures contracts lock in the current price of a commodity or stock and define the current fixed cost of the underlying asset and its expiry date. If you have carried out research or seen posts online that point to the price of oil rising, one way to take a long position in the market is to buy an oil future. Connect with a member of our expert equity team for more information about our products. It gives you the tools you need to trade not just one market, but several markets, if you wish!EMini Futures Trading Your Complete, StepbyStep Guide

How to Trade EMini Futures Comprehensive Guide

Emini Futures Contract Trading Strategy Made Easy

Trading EMini Futures emini

Trading EMini Futures emini

How to Exploit Micro EMini Futures in Day Trading Real Trading

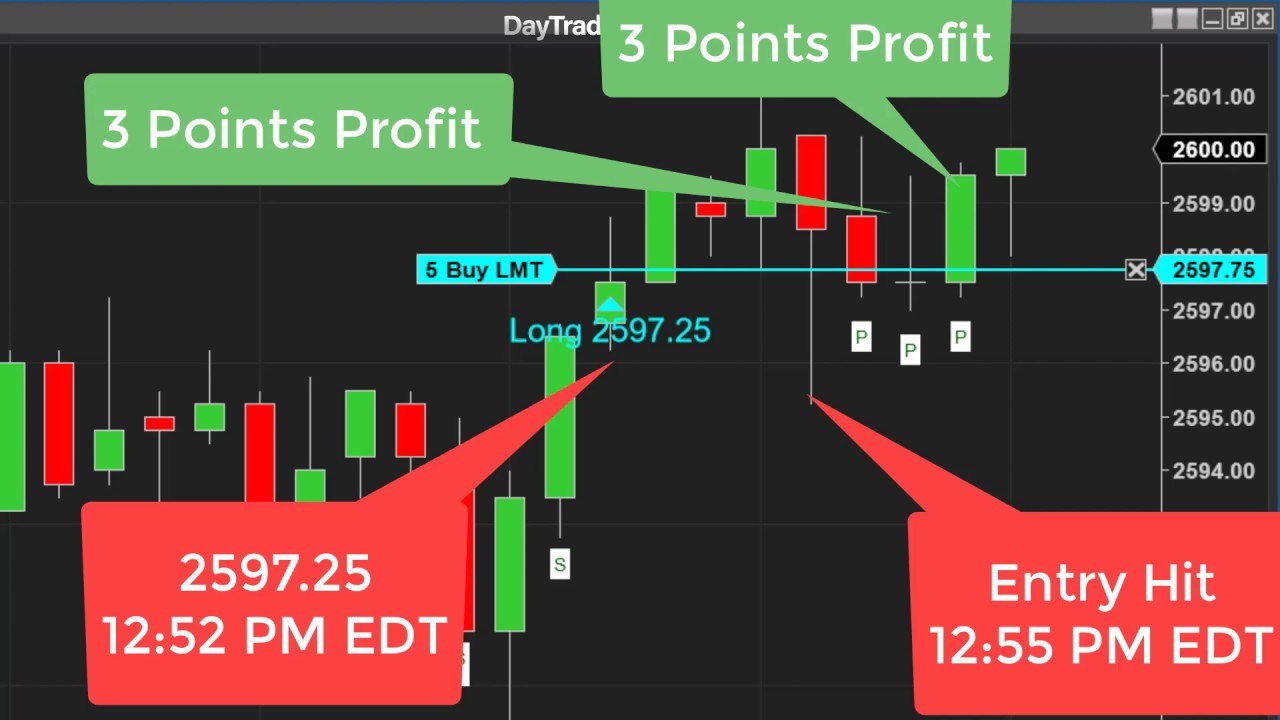

Two Great 3Point Emini Scalping Trades Emini Futures Trading Course

Trading EMinis Futures Trading Course

Trading EMinis Archives Futures Trading Course

EMini Futures Trading Course Traders' Academy

As Futures Are Leveraged, Trades Can Become Very Profitable Or Incur A Significant Loss.leverage Means Traders Do Not Have To.

These Contracts Obligate The Buyer To Buy And The Seller To Sell, Even If The Price Goes Against The Trade.

Learn About The Benefits Of Futures Including Margin & Capital Efficiency, Tax Considerations, And Market Liquidity.

Futures Contracts Often Require Margin Deposits That Can Be Prohibitive For Individual Traders.

Related Post: