Ebitda Course

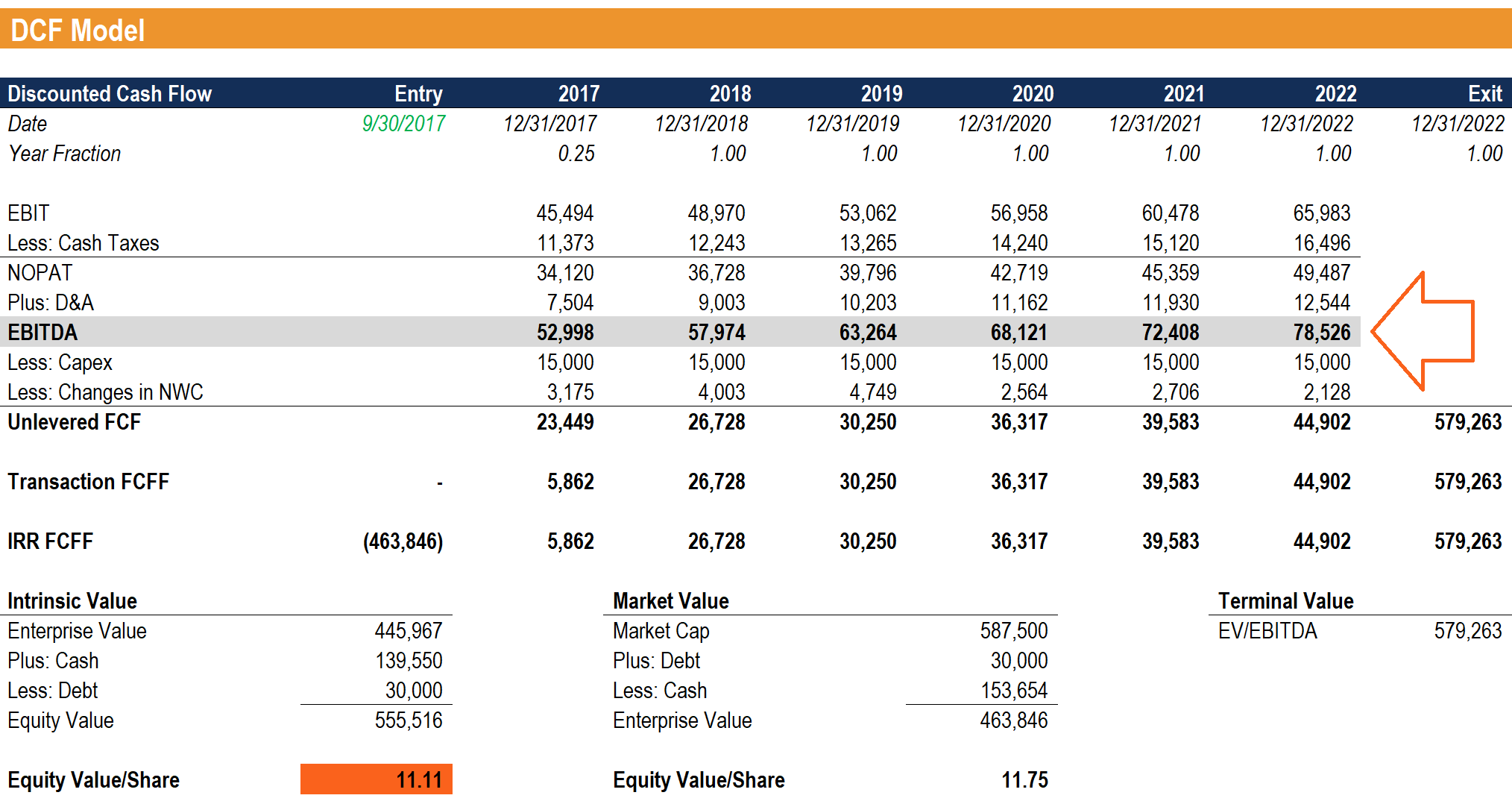

Ebitda Course - Ebitda boils down a company’s financial information to its bare bones. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. Take our financial ratios exam. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. In contrast, the formula to. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Learn how to analyze income statements and ebitda performance with this comprehensive course. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Understand variances, calculate gross profit, and visualize perfor. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. Learn how to analyze income statements and ebitda performance with this comprehensive course. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Understand variances, calculate gross profit, and visualize perfor. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. Ebitda multiples are a critical tool for evaluating the value of a business in the private equity and m&a industry. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Watch this free acca apm video explaining ebitda. Specifically, it provides a clearer understanding of operating profitability and general cash flow. Specifically, it provides a clearer understanding of operating profitability and general cash flow. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. In contrast, the formula to. Watch this free acca apm video explaining ebitda. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Learn how to analyze income statements and ebitda performance with this comprehensive course. Ebitda boils down a company’s financial information to its bare bones. Specifically, it provides a clearer understanding of operating profitability and general cash flow. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Take our financial ratios exam. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Specifically, it provides a clearer understanding of operating profitability and general cash flow. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Specifically, it provides a clearer understanding of operating profitability and general cash flow. Watch this free acca apm video explaining ebitda. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability.. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Watch this free acca. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. Learn how to analyze income statements and ebitda performance with this comprehensive course. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. In this tutorial,. Ebitda multiples are a critical tool for evaluating the value of a business in the private equity and m&a industry. Understand variances, calculate gross profit, and visualize perfor. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Watch this free acca apm video explaining ebitda. Specifically, it provides a clearer. Understand variances, calculate gross profit, and visualize perfor. Ebitda boils down a company’s financial information to its bare bones. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Specifically, it provides a clearer understanding of operating profitability and general cash flow. You’ll learn how m&a. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. Ebitda multiples are a critical tool for evaluating the value of a business in the private equity and m&a industry. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Learn how ebitda impacts investment decisions, valuation techniques,. In contrast, the formula to. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. Understand variances, calculate gross profit, and visualize perfor. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. Specifically, it provides a clearer understanding of operating. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Ebitda boils down a company’s financial information to its bare bones. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Understand variances, calculate gross profit, and visualize perfor. Specifically, it provides a clearer understanding of operating profitability and general cash flow. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Take our financial ratios exam. Learn how to analyze income statements and ebitda performance with this comprehensive course. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. In contrast, the formula to. Watch this free acca apm video explaining ebitda.Lecture 9 Calculating Operating Profit & EBITDA Course Tableau for

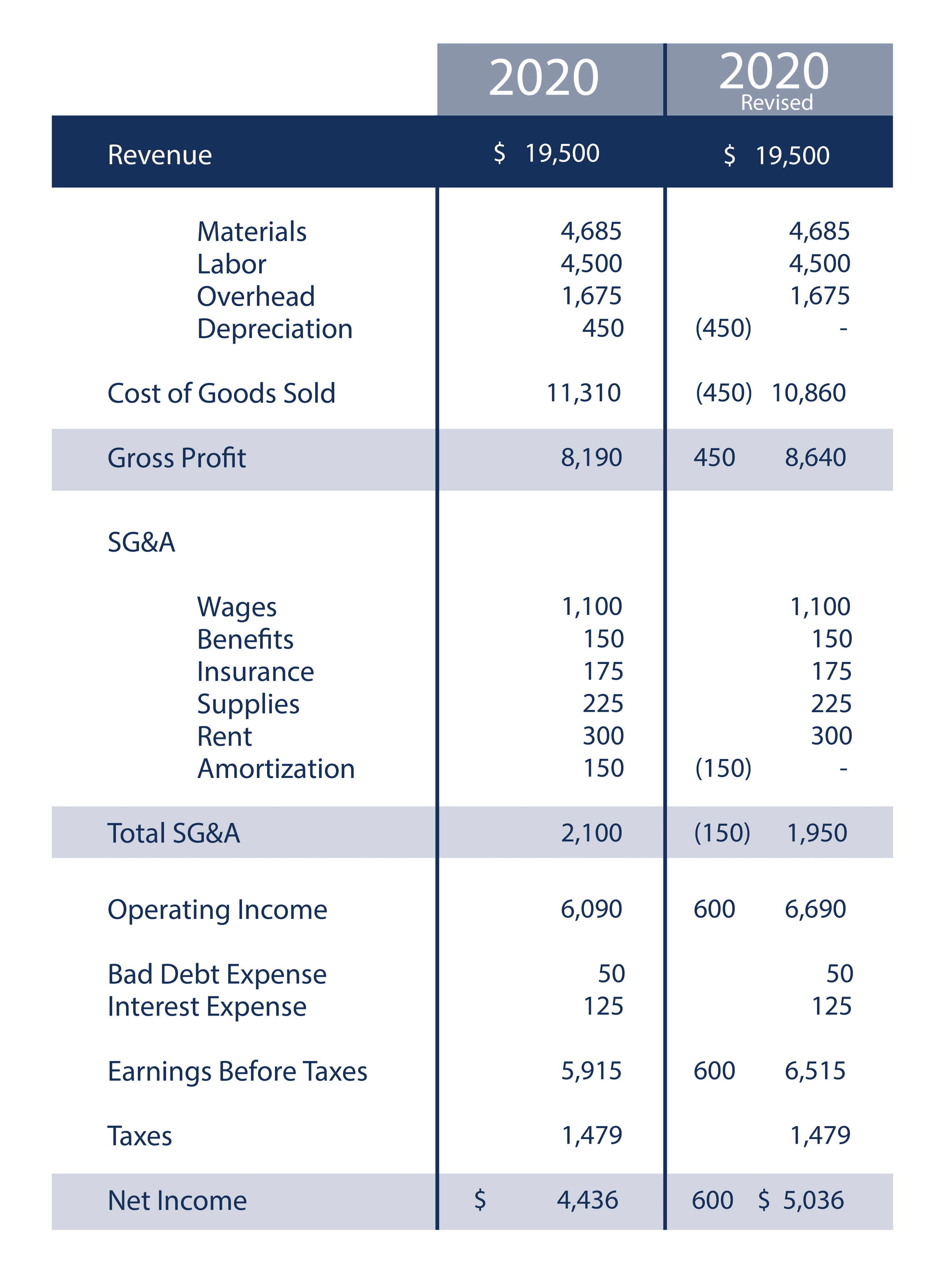

Lecture 7 Calculating Gross Profit & EBITDA (Course Financial

A Guide to Ebitda EBITDA 1 Swipe 1 CFO for Startups Founder & CEO

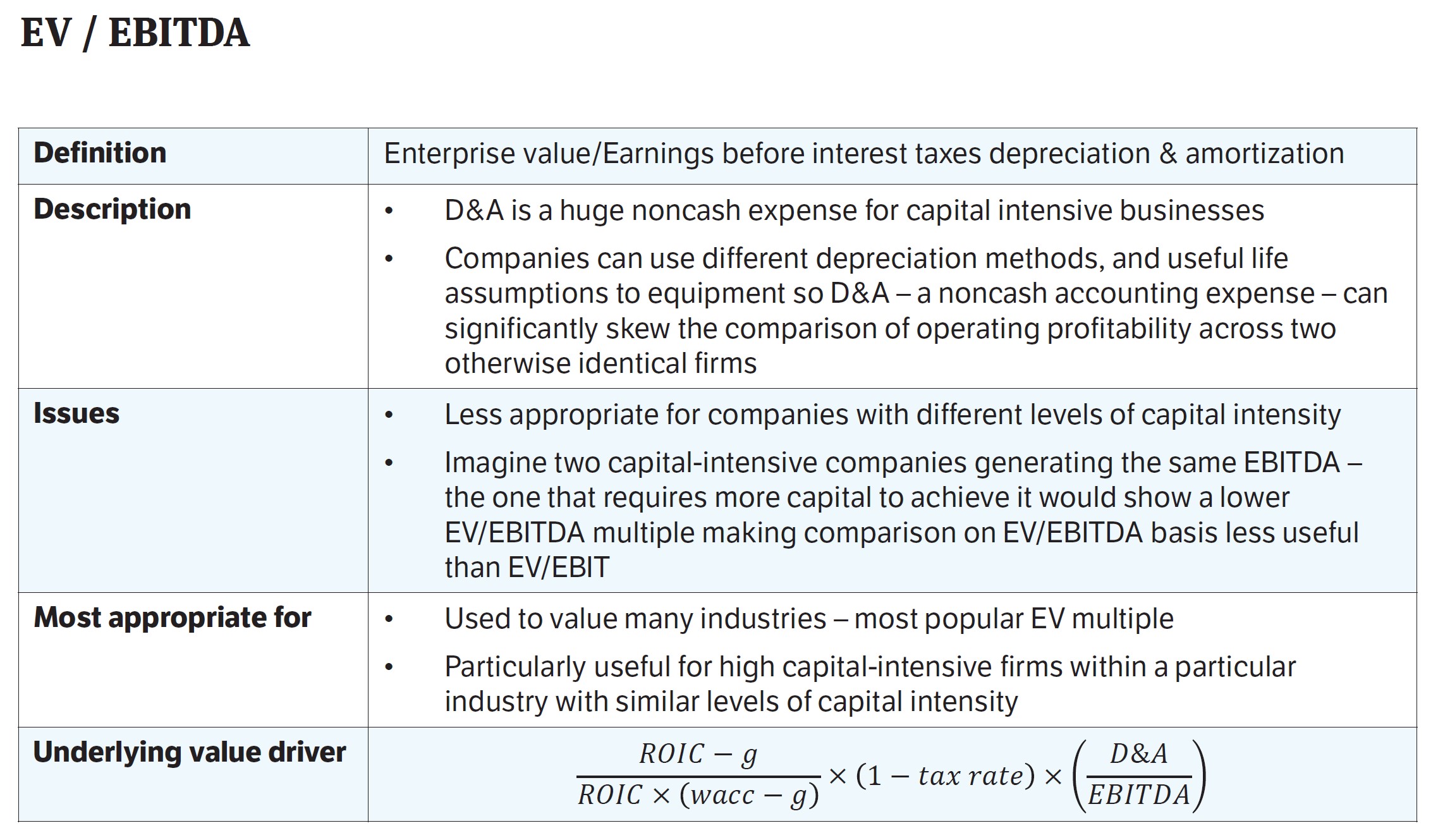

EV/EBITDA Multiple EUVietnam Business Network (EVBN)

[Solved] using EBITDA Calculation, Balance Sheets, and

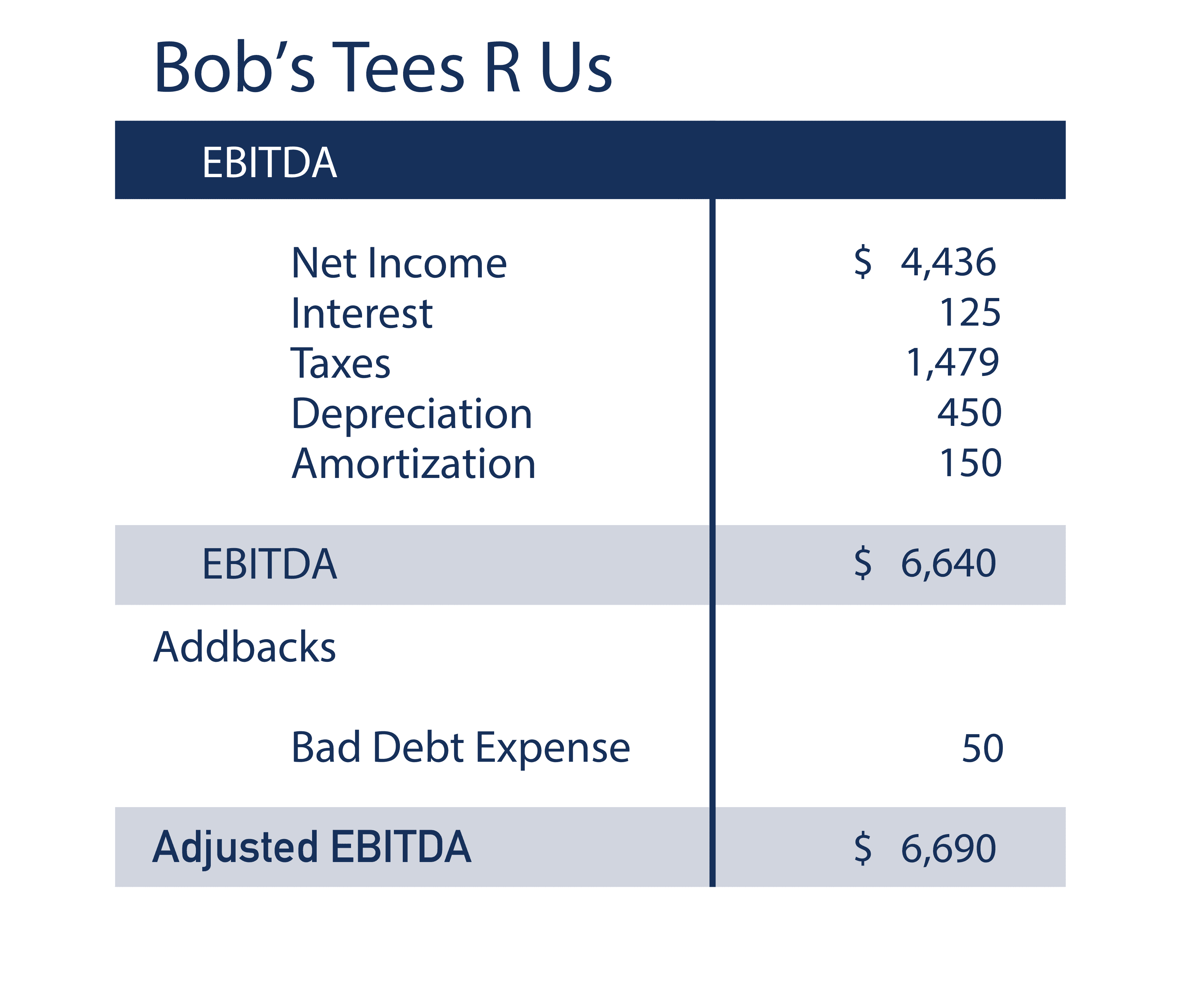

Mastering EBITDA Your GoTo Cheat Sheet for Financial Analysis! 📊💪

[Solved] using EBITDA Calculation, Balance Sheets, and

Full EBITDA Guide What is It & How Investors Use It (Formula)

What is EBITDA Formula, Definition and Explanation

Full EBITDA Guide What is It & How Investors Use It (Formula)

Earnings Before Interest, Taxes, Depreciation, And Amortization—Also Called Ebitda—Is A Record Of The Amount Of Money A Company Generated.

Gain Practical Insights Into Adjusting Ebitda For Accurate Financial Modeling, And Understand.

Ebitda Multiples Are A Critical Tool For Evaluating The Value Of A Business In The Private Equity And M&A Industry.

By Understanding The Factors That Influence These Multiples, Such As Industry,.

Related Post: