Holder In Due Course Rule

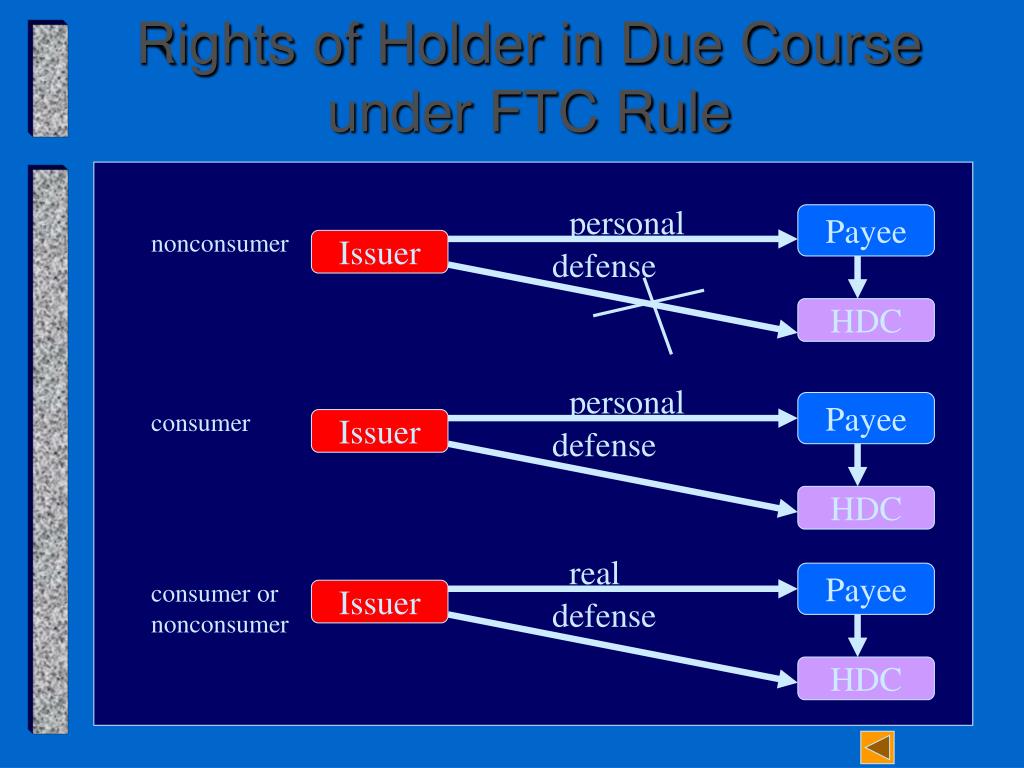

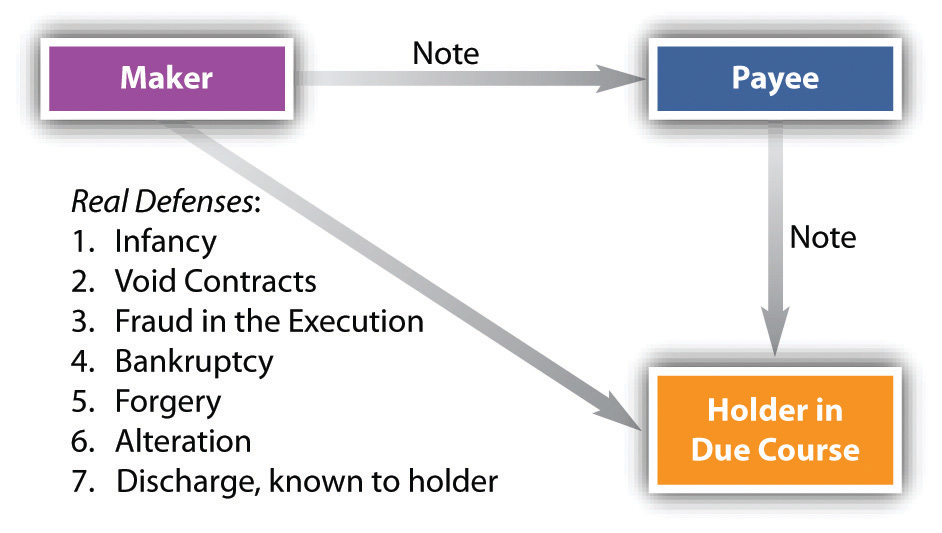

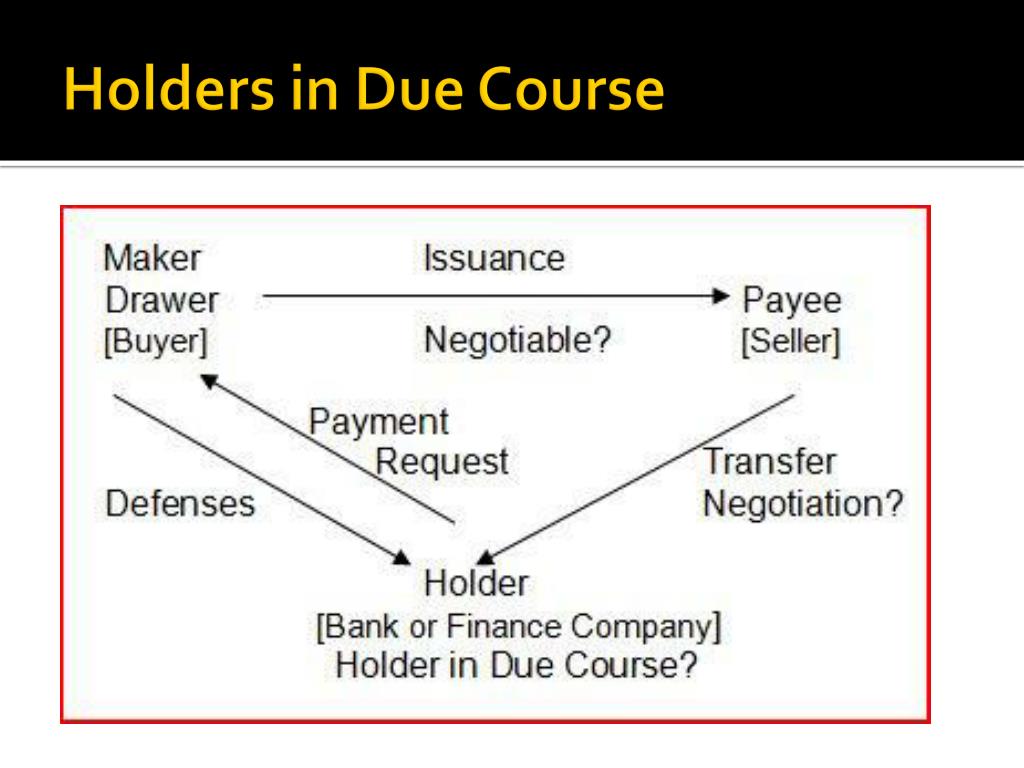

Holder In Due Course Rule - The holder in due course doctrine as a default rule. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; This section defines the term holder in due course and the conditions for acquiring and enforcing rights as a holder. Summarize the requirements to be a holder in due course. It also explains the exceptions, limitations, and notice requirements for. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and defenses, protects consumers when merchants sell a consumer's credit contracts to other. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. A holder in due course can sell his or her rights to the check to anyone, at any time, and at any price. The rule was developed so that negotiable. It also explains the exceptions, limitations, and notice requirements for. Summarize the requirements to be a holder in due course. As you will read in the new jersey appellate court case between robert triffin and. The holder in due course doctrine as a default rule. This section defines the term holder in due course and the conditions for acquiring and enforcing rights as a holder. The rule provides that anyone purchasing the credit instrument does so subject to all or any claims and defenses that the consumer might have against the seller of goods. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; Payee may become a holder in due course if she satisfies all of the requirements. The holder in due course doctrine as a default rule. Helped over 8mm worldwide12mm+ questions answered The holder in due course doctrine as a default rule. A holder in due course is a holder who takes the instrument for value and in good faith and without notice that it is overdue or has been dishonored or of any defense or claim to it on the. Why is it unlikely that a payee. Why is the status. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and defenses, protects consumers when merchants sell a consumer's credit contracts to other. Summarize the requirements to be a holder in due course. The rule provides that anyone purchasing the credit instrument does so subject to. A holder in due course is a holder who takes the instrument for value and in good faith and without notice that it is overdue or has been dishonored or of any defense or claim to it on the. The holder in due course doctrine as a default rule. A holder in due course is any person who receives or. The rule was developed so that negotiable. Helped over 8mm worldwide12mm+ questions answered The holder in due course doctrine as a default rule. Payee may become a holder in due course if she satisfies all of the requirements. Under this doctrine, the obligation to pay. The rule was developed so that negotiable. Payee may become a holder in due course if she satisfies all of the requirements. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; The preservation of consumers’ claims and defenses [holder. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and defenses, protects consumers when merchants sell a consumer's credit contracts to other. It also explains the exceptions, limitations, and notice requirements for. Under ucc article 3, a holder in due course is someone who acquires. The rule was developed so that negotiable. As you will read in the new jersey appellate court case between robert triffin and. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and defenses, protects consumers when merchants sell a consumer's credit contracts to other. The. This section defines the term holder in due course and the conditions for acquiring and enforcing rights as a holder. The holder in due course doctrine as a default rule. The rule provides that anyone purchasing the credit instrument does so subject to all or any claims and defenses that the consumer might have against the seller of goods. Under. A holder in due course is a holder who takes the instrument for value and in good faith and without notice that it is overdue or has been dishonored or of any defense or claim to it on the. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. Under this doctrine, the obligation to pay. Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due. Payee may become a holder in due course if she satisfies all of the requirements. A holder in. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; Why is the status of holder in due course important in commercial transactions? Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. The rule provides that anyone purchasing the credit instrument does so subject to all or any claims and defenses that the consumer might have against the seller of goods. A holder in due course is a holder who takes the instrument for value and in good faith and without notice that it is overdue or has been dishonored or of any defense or claim to it on the. Under this doctrine, the obligation to pay. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; As you will read in the new jersey appellate court case between robert triffin and. Why is it unlikely that a payee. Helped over 8mm worldwide12mm+ questions answered It also explains the exceptions, limitations, and notice requirements for. A holder in due course can sell his or her rights to the check to anyone, at any time, and at any price. The rule was developed so that negotiable. The holder in due course doctrine as a default rule. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due.PPT Business Law and the Regulation of Business Chapter 26 Holder in

Holder and Holder in Due Course HolderAccording To Section 8 of The

Holder in due course Negotiable Instrument Act Law VNSGU

Holder and Holder in Due Course PDF Negotiable Instrument Common Law

Defense Credit Union Council’s ppt download

Holder and Holder in Due Course PDF Negotiable Instrument Private Law

Holder in Due Course PDF Negotiable Instrument Common Law

Holder in Due Course and Defenses

Holder and Holder in Due Course PDF Negotiable Instrument

Holder In Due Course Section 9 at Debi Combs blog

This Section Defines The Term Holder In Due Course And The Conditions For Acquiring And Enforcing Rights As A Holder.

Summarize The Requirements To Be A Holder In Due Course.

If You Do, You Should Know Something About The Holder In Due Course (“Hdc”) Rule Contained In Article 3 Of The Uniform Commercial Code.

The Preservation Of Consumers’ Claims And Defenses [Holder In Due Course Rule], Formally Known As The Trade Regulation Rule Concerning Preservation Of Consumers' Claims And Defenses, Protects Consumers When Merchants Sell A Consumer's Credit Contracts To Other.

Related Post: