How Much Does A Tax Preparer Course Cost

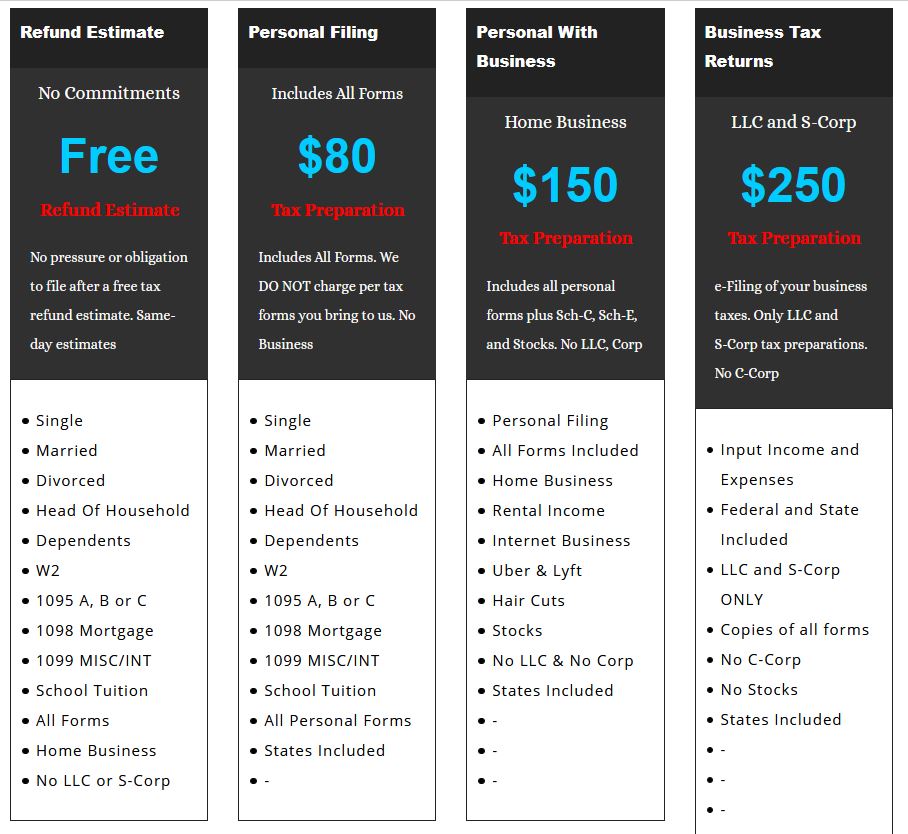

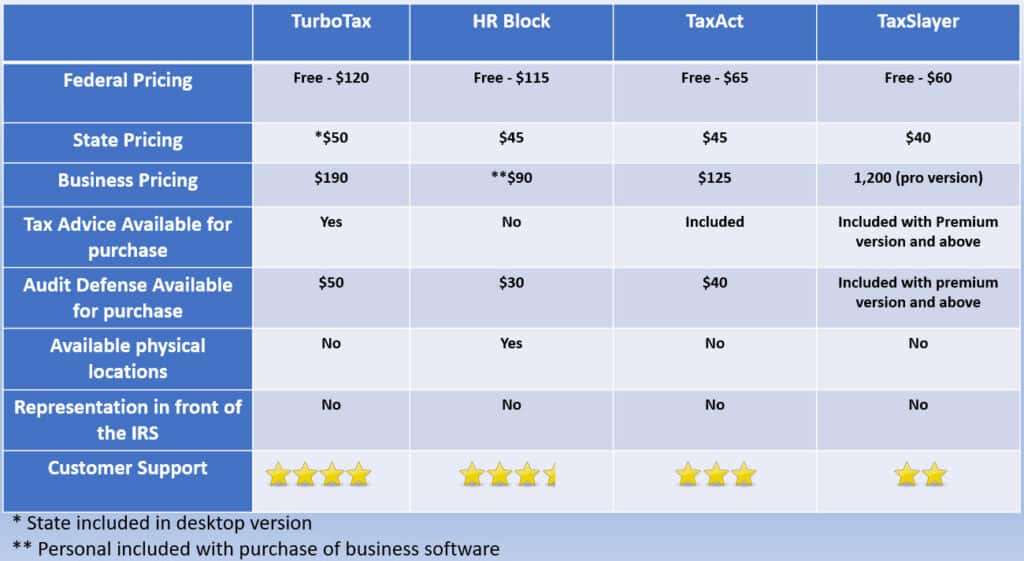

How Much Does A Tax Preparer Course Cost - Permanent employees, h&r block says, are eligible for paid benefits. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. Don’t worry, they don’t actually cost $5,000. Grading is done within 24 hours. Will this online tax preparation. Apply for a preparer tax identification number (ptin) from the irs; Become a certified tax preparer. According to the bureau of labor statistics a tax preparer makes a median salary of $48,250 annually ††. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Complete our comprehensive tax course; The cost to become a tax preparer varies greatly by region. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. How much does a tax preparer make? According to payscale, tax preparers working for h&r block average about $13.60 per hour. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make informed decisions about their education. Tax preparers must take various state and federal exams to obtain their state certificate after which they can be licensed to file taxes. Become a certified tax preparer. Passing the cpa exam without a solid cpa exam review course is extremely rare. Apply for a preparer tax identification number (ptin) from the irs; And how do i pay for it? We’ve even asked our experts. The cost to become a tax preparer varies greatly by region. And how do i pay for it? Will this online tax preparation. Penn foster offers an affordable online tax preparation program to help students learn for less. How do i know the total cost of the tax preparation class. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make informed decisions about their education. View our full tuition and payment options here. According to payscale, tax preparers working for h&r block average about $13.60 per hour. Penn foster offers an. Permanent employees, h&r block says, are eligible for paid benefits. The irs charges a $19.75 fee to apply for (or renew) a ptin. To become a ctec registered tax preparer, the california tax education council requires you to hold and maintain a $5,000 tax preparer bond. Tax preparers must take various state and federal exams to obtain their state certificate. The irs charges a $19.75 fee to apply for (or renew) a ptin. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Don’t worry, they don’t actually cost $5,000. How much does a tax preparer make? Grow your careeronline programsmall class sizes100% online Penn foster offers an affordable online tax preparation program to help students learn for less. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Passing the cpa exam without a solid cpa exam review course is extremely rare. Grow your careeronline programsmall class sizes100% online The. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. Don’t worry, they don’t actually cost $5,000. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make informed decisions about their education. The cost to become a tax preparer varies. How much does a tax preparer make? The irs charges a $19.75 fee to apply for (or renew) a ptin. The cost to become a tax preparer varies greatly by region. And how do i pay for it? According to payscale, tax preparers working for h&r block average about $13.60 per hour. Passing the cpa exam without a solid cpa exam review course is extremely rare. The irs charges a $19.75 fee to apply for (or renew) a ptin. Grow your careeronline programsmall class sizes100% online Continue your education and stay up to date. According to the bureau of labor statistics a tax preparer makes a median salary of $48,250 annually ††. How much does a tax preparer make? We’ve even asked our experts. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. How do i know the total cost of the tax preparation class. And how do i pay. Tax preparers must take various state and federal exams to obtain their state certificate after which they can be licensed to file taxes. The irs charges a $19.75 fee to apply for (or renew) a ptin. Don’t worry, they don’t actually cost $5,000. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make. Penn foster offers an affordable online tax preparation program to help students learn for less. Passing the cpa exam without a solid cpa exam review course is extremely rare. View our full tuition and payment options here. Ashworth college's flexible tuition options for the online tax preparation training covers your course materials, certification exam and practice test. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make informed decisions about their education. Will this online tax preparation. How much does a tax preparer make? Grading is done within 24 hours. Permanent employees, h&r block says, are eligible for paid benefits. Don’t worry, they don’t actually cost $5,000. Continue your education and stay up to date. Apply for a preparer tax identification number (ptin) from the irs; While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. Become a certified tax preparer. Once i complete the course how long before the irs (or ctec) is notified of my hours? According to payscale, tax preparers working for h&r block average about $13.60 per hour.Tax Preparation Fees and Pricing at 80 TaxRecover

Tax Preparation Fees 2024 Pen Kathie

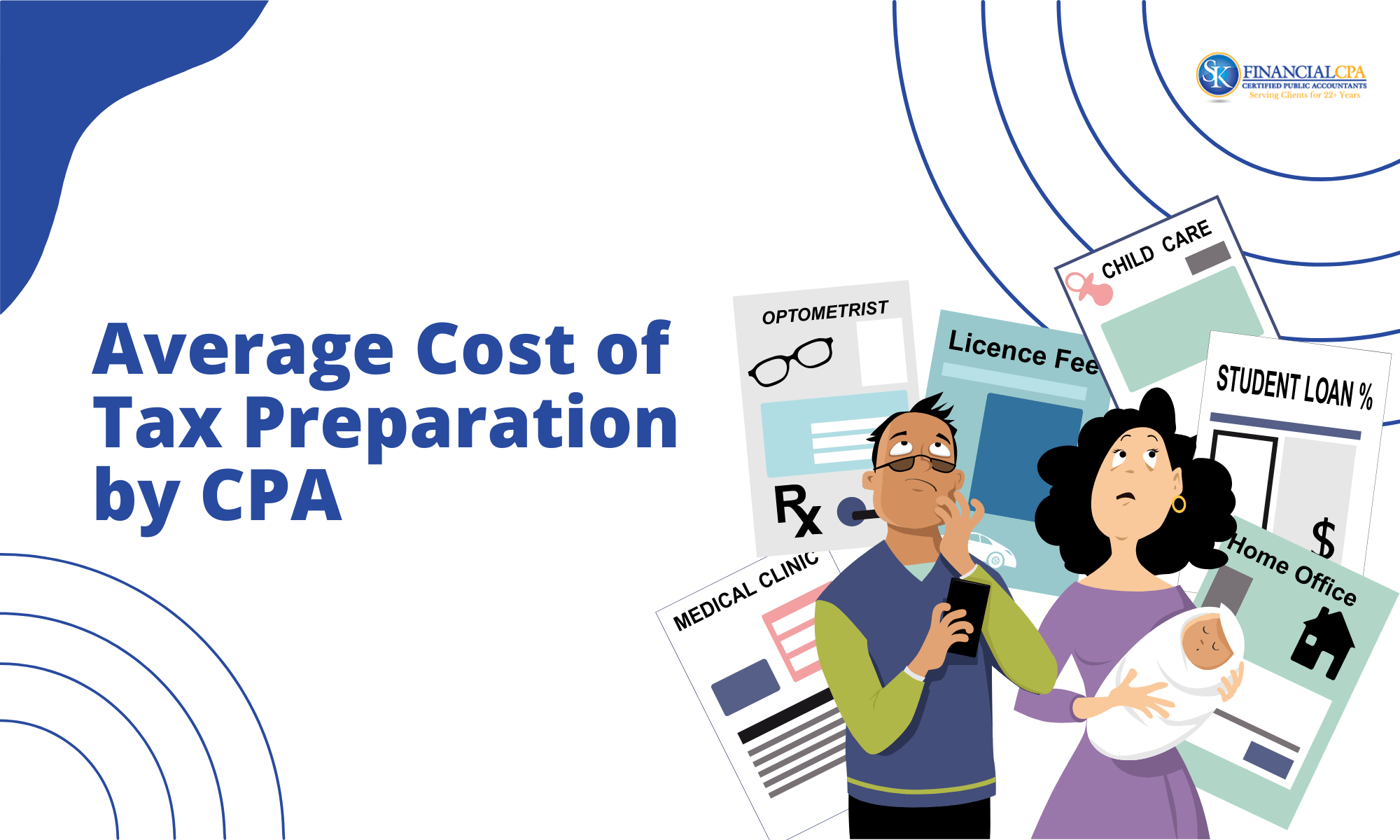

Average Cost of Tax Preparation by CPA Business and Personal Tax

Tax Preparation Pricing Options ARA Government Services, LLC

NSA Survey Reveals Fee and Expense Data For Tax Accounting Firms in

How Much Does a Tax Preparer Course Cost? Why Universal Accounting

How Much Does Tax Preparation Cost?

Tax Preparation Fees 2024 Pen Kathie

Understand Tax Preparer Course Costs Invest in Your Career

How Much Does a Tax Preparer Course Cost? Why Universal Accounting

The Irs Charges A $19.75 Fee To Apply For (Or Renew) A Ptin.

According To The Bureau Of Labor Statistics A Tax Preparer Makes A Median Salary Of $48,250 Annually ††.

The Total Tuition Fees For The Tax Courses Are Clearly Stated On The Enrollment Forms.

How Do I Know The Total Cost Of The Tax Preparation Class.

Related Post:

/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)