Miami Dade College Tax Preparation Course

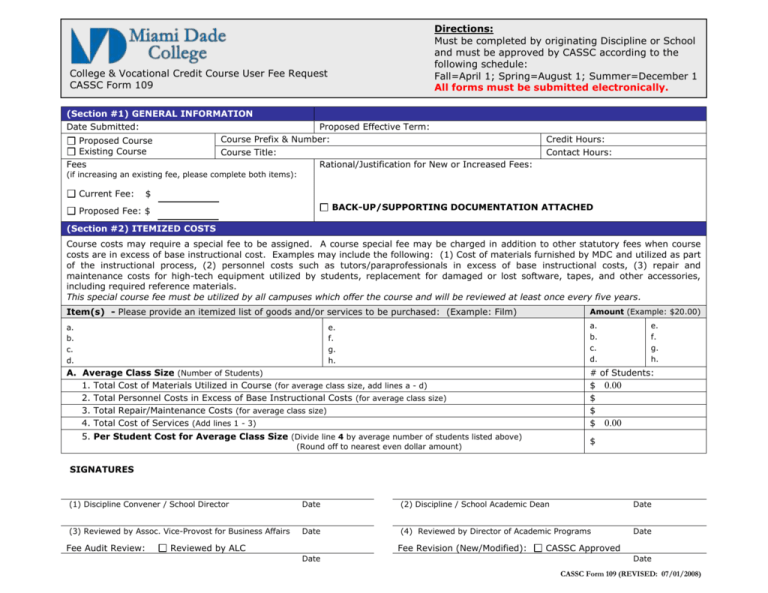

Miami Dade College Tax Preparation Course - Learn the fundamental requirements for filing a personal income tax return. Federal income tax fundamentals with emphasis on individual returns. All tax courses at miami dade college, kendall (mdc kendall) in miami, florida. Tax 2000 at miami dade college, kendall (mdc kendall) in miami, florida. Particular emphasis will be directed to the unitary business principle, the determination of apportion income, the apportionment formula, combined reporting and various other issues associated with income attribution and. Wbtp 109 at miami dade college, north (mdc north) in miami, florida. Topics considered include gross income, capital gains and losses, deductions and exemptions, and tax credits. Miami dade college (mdc) once again will offer free tax preparation services to individuals who earned $57,000 or less as part of the internal revenue’s volunteer income tax assistance. Tax 2000 at miami dade college (mdc wolfson) in miami, florida. This course covers current standards and regulations related to individual preparation. Learn the fundamental requirements for filing a personal income tax return. Wbtp 109 at miami dade college, north (mdc north) in miami, florida. Wbfm 150 at miami dade college, north (mdc north) in miami, florida. Students acquire skills to determine, calculate, and categorize sources of income, losses, and deductions. Tax 2000 at miami dade college, kendall (mdc kendall) in miami, florida. Topics include requirements for filing an income tax return, dependents, taxable and nontaxable income, deductions and exemptions and tax credits. The vita program generally offers free tax help to people who make $67,000 or less and need assistance in preparing their own tax returns. This course provides participants with an understanding of the principles and limitations of corporate income taxes. Aprenda los fundamentos sobre el impuesto individual federal y capacítate para poder elaborar: Topics considered include gross income, capital gains and losses, deductions and exemptions, and tax credits. In addition, students will learn how to reduce taxable income and discover the current income tax regulations and their impact on individuals, couples, families, and business owners. Learn the fundamental requirements for filing a personal income tax return. Learn the fundamental requirements for filing a personal income tax return. Tax 2000 at miami dade college (mdc wolfson) in miami, florida.. Students can choose from two tracks including accounting clerk and tax specialist. The program is also available online. This course covers current standards and regulations related to individual preparation. Aprenda los fundamentos sobre el impuesto individual federal y capacítate para poder elaborar: This course provides participants with an understanding of the principles and limitations of corporate income taxes. This course provides participants with an understanding of the principles and limitations of corporate income taxes. All tax courses at miami dade college, kendall (mdc kendall) in miami, florida. Aprenda los fundamentos sobre el impuesto individual federal y capacítate para poder elaborar: Emphasis is placed on record keeping, preparation, and filing of forms and schedules. The college credit certificate in. The program is also available online. Topics include requirements for filing an income tax return, dependents, taxable and nontaxable income, deductions and exemptions and tax credits. Aprenda los fundamentos sobre el impuesto individual federal y capacítate para poder elaborar: Learn the fundamental requirements for filing a personal income tax return. In addition, students will learn how to reduce taxable income. Tax 2000 at miami dade college (mdc wolfson) in miami, florida. See if you qualify for education, earned income, and child tax credits. Courses required may include financial accounting, managerial accounting, accounting software technologies, excel for business and tax of estates, gifts and trusts. All tax courses at miami dade college (mdc wolfson) in miami, florida. Una declaración de impuesto. Federal income tax fundamentals with emphasis on individual returns. Topics considered include gross income, capital gains and losses, deductions and exemptions, and tax credits. The college credit certificate in tax specialist will prepare students to fill out the necessary forms for their clients or for the businesses in which they work. Aprenda los fundamentos sobre el impuesto individual federal y. Courses required may include financial accounting, managerial accounting, accounting software technologies, excel for business and tax of estates, gifts and trusts. Topics include requirements for filing an income tax return, dependents, taxable and nontaxable income, deductions and exemptions and tax credits. Wbtp 109 at miami dade college, north (mdc north) in miami, florida. Topics considered include gross income, capital gains. Federal income tax fundamentals with emphasis on individual returns. In addition, students will learn how to reduce taxable income and discover the current income tax regulations and their impact on individuals, couples, families, and business owners. Topics considered include gross income, capital gains and losses, deductions and exemptions, and tax credits. This course provides participants with an understanding of the. Students acquire skills to determine, calculate, and categorize sources of income, losses, and deductions. Topics include requirements for filing an income tax return, dependents, taxable and nontaxable income, deductions and exemptions and tax. Wbtp 109 at miami dade college, north (mdc north) in miami, florida. Tax 2000 at miami dade college, kendall (mdc kendall) in miami, florida. This course provides. This course provides participants with an understanding of the principles and limitations of corporate income taxes. See if you qualify for education, earned income, and child tax credits. Learn the fundamental requirements for filing a personal income tax return. All tax courses at miami dade college (mdc wolfson) in miami, florida. Topics considered include gross income, capital gains and losses,. The college credit certificate in tax specialist will prepare students to fill out the necessary forms for their clients or for the businesses in which they work. In addition, students will learn how to reduce taxable income and discover the current income tax regulations and their impact on individuals, couples, families, and business owners. Topics include requirements for filing an income tax return, dependents, taxable and nontaxable income, deductions and exemptions and tax credits. Learn the fundamental requirements for filing a personal income tax return. Miami dade college once again offers free tax preparation at six campuses miami, dec. Students can choose from two tracks including accounting clerk and tax specialist. Federal income tax fundamentals with emphasis on individual returns. This course provides participants with an understanding of the principles and limitations of corporate income taxes. Una declaración de impuesto individual federal, anexos, estados y hojas de trabajo para preparar la declaración individual de pago de impuesto, reembolso o pago impuesto, penalidades y otros formularios relacionados. Courses required may include financial accounting, managerial accounting, accounting software technologies, excel for business and tax of estates, gifts and trusts. Tax 2000 at miami dade college, kendall (mdc kendall) in miami, florida. All tax courses at miami dade college, kendall (mdc kendall) in miami, florida. Students acquire skills to determine, calculate, and categorize sources of income, losses, and deductions. Topics considered include gross income, capital gains and losses, deductions and exemptions, and tax credits. This course provides participants with an understanding of the principles and limitations of corporate income taxes. This course covers current standards and regulations related to individual preparation.ATAX Tax Preparation School

About Miami Dade College Miami Dade College has the largest

Miami Dade College Free Courses 2024 Tessa Fredelia

Attendance Options Miami Dade College

North Campus VITA Tax Preparation Assistance Miami Dade College

Miami Dade College on LinkedIn Miami Dade College Offers Free Tax

MIAMI DADE COLLEGE

11 Best Tax Courses To Take In 2025 The CFO Club

Tax Preparation Course eBook

Miami Dade College Free Courses 2025 Aggie Starlene

The Vita Program Generally Offers Free Tax Help To People Who Make $67,000 Or Less And Need Assistance In Preparing Their Own Tax Returns.

Learn The Fundamental Requirements For Filing A Personal Income Tax Return.

Learn The Fundamental Requirements For Filing A Personal Income Tax Return.

Wbtp 109 At Miami Dade College, North (Mdc North) In Miami, Florida.

Related Post: