Tax Equity Modeling Course

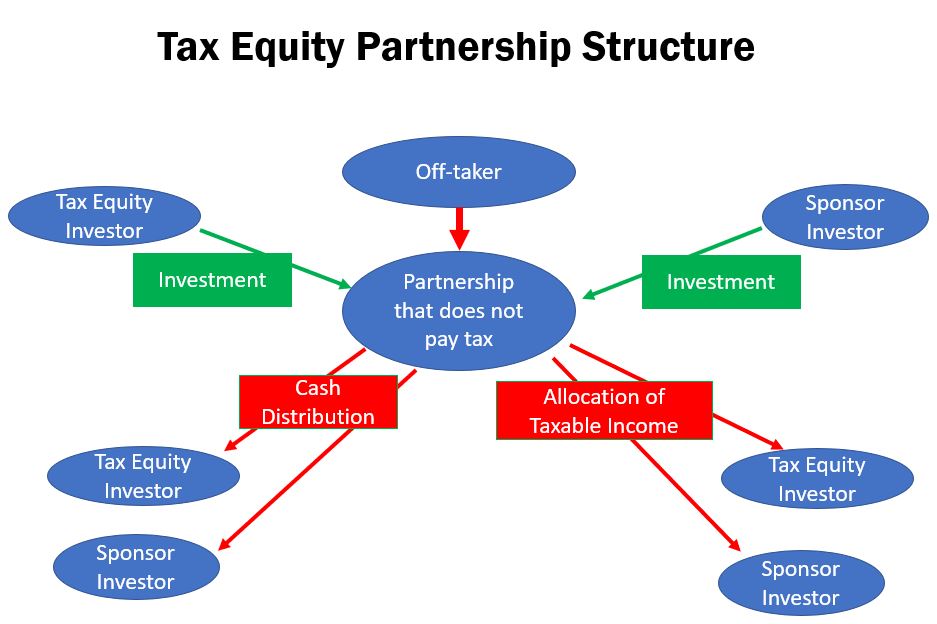

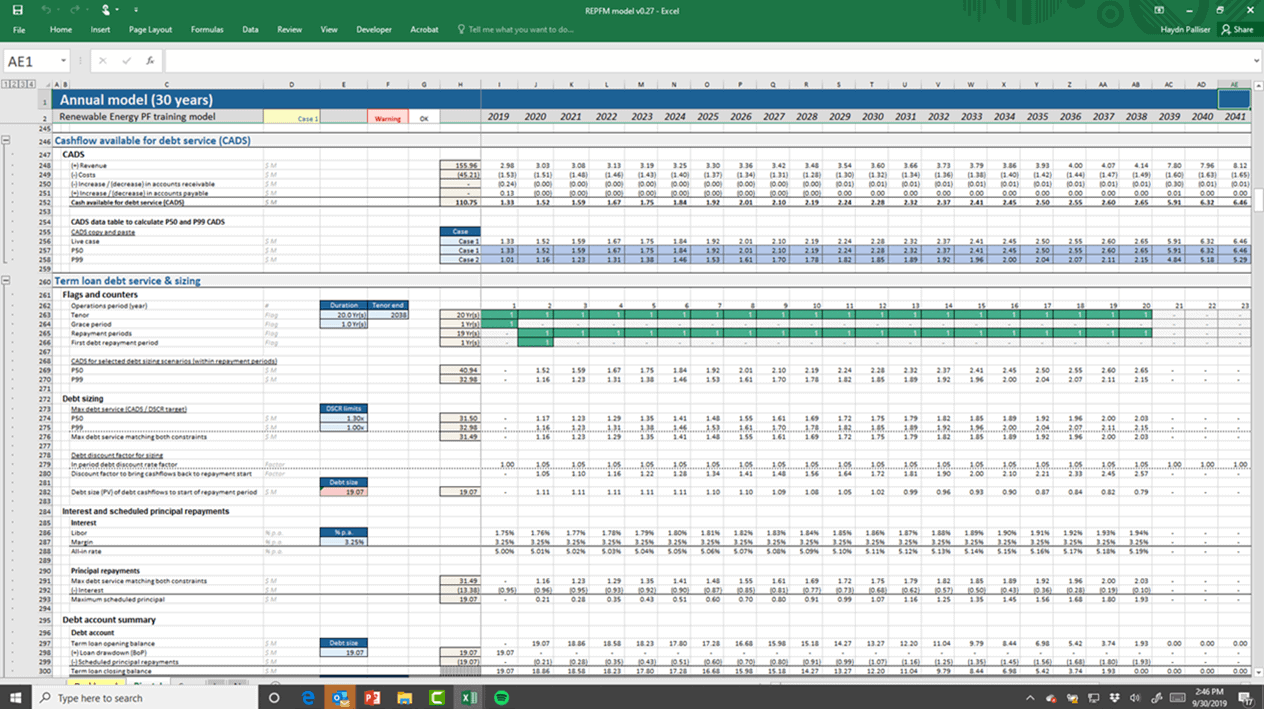

Tax Equity Modeling Course - Develop best practice techniques in order to calculate and analyse returns at. This is an intensive course providing an overview of the tax equity structures commonly used in u.s. Renewable energy investments, with a focus on the development of a. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Recognize drivers and structure of tax equity transactions; Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. Financial modeling and valuation, 2. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Financial modeling & corporate valuation, 3. Enroll in course to unlock. 6 schools | 4 courses. Financial modeling and valuation, 2. By the end of this course, you. Enroll in course to unlock. Each listing includes the course number,. Financial modeling & corporate valuation, 3. Recognize drivers and structure of tax equity transactions; Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Financial modeling & corporate valuation, 3. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial model that takes into account the tax credits available in the us, and. Financial modeling and valuation, 2. This is an intensive course providing. This is an intensive course providing an overview of the tax equity structures commonly used in u.s. Financial modeling and valuation, 2. Develop best practice techniques in order to calculate and analyse returns at. Renewable energy investments, with a focus on the development of a. 6 schools | 4 courses. Financial modeling and valuation, 2. Develop best practice techniques in order to calculate and analyse returns at. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. This is an intensive course providing an overview of the tax equity structures commonly used in u.s. Recognize drivers and structure of tax equity transactions; Pivotal180 offers self paced online training to learn project finance financial modeling from ivy league professors. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Develop best practice techniques in order to calculate and analyse returns at. Recognize drivers and structure of tax equity transactions; 6 schools. Whether you’re an investor, analyst, or developer, our training. Develop best practice techniques in order to calculate and analyse returns at. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Enroll in course to unlock. Each listing includes the course number,. Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. This page includes files and videos for a course. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield. Whether you’re an investor, analyst, or developer, our training. Develop best practice techniques in order to calculate and analyse returns at. 6 schools | 4 courses. Renewable energy investments, with a focus on the development of a. Recognize drivers and structure of tax equity transactions; Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. 6 schools | 4 courses. Enroll in course to unlock. Renewable energy investments, with a focus on the development of a. This page includes files and videos for a course on tax equity modelling. Renewable energy investments, with a focus on the development of a. Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. Enroll in course to unlock. Renewable energy investments, with a focus on the development of a. This page includes files and videos for a course on tax equity modelling. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Enroll in course to unlock. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial model that takes into account the tax credits available in the us, and. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. By the end of this course, you. Enroll in course to unlock. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Enroll in course to unlock. 6 schools | 4 courses. Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. This page includes files and videos for a course on tax equity modelling. Pivotal180 offers self paced online training to learn project finance financial modeling from ivy league professors. Financial modeling & corporate valuation, 3. Renewable energy investments, with a focus on the development of a. Whether you’re an investor, analyst, or developer, our training. Renewable energy investments, with a focus on the development of a. Recognize drivers and structure of tax equity transactions; Financial modeling and valuation, 2.Tax Equity Financing and Waterfall Modelling Part 1 YouTube

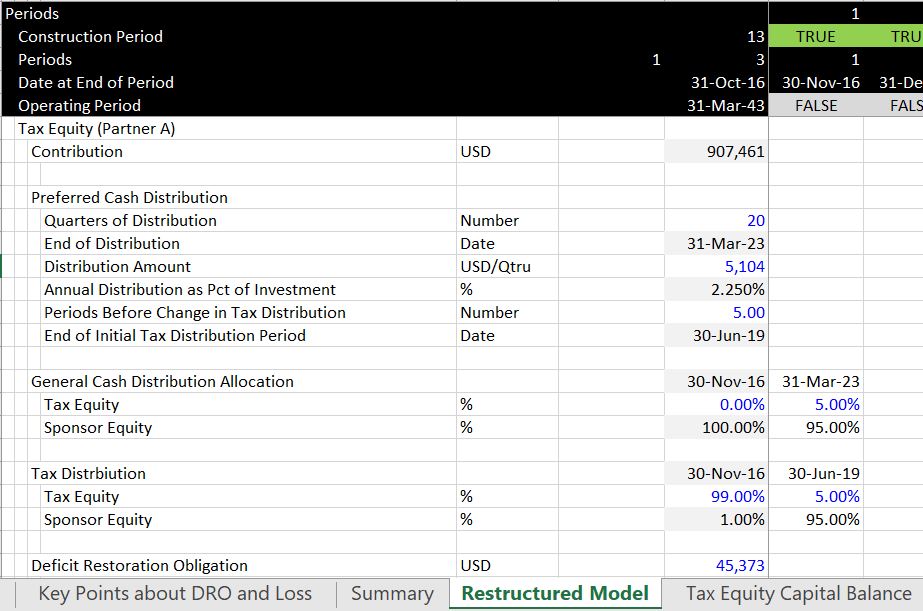

Capital Accounts in Tax Equity Financial Modeling for Renewable

Modeling Investment Tax Credit for Solar Projects in US (Tax Equity

What is a Tax Equity Flip Structure? Financial Modeling for Renewable

Yield Based Flip and Partnership Allocation (Generally for Wind

DCF Model Training The Ultimate Free Guide to DCF Models

Tax Equity Model Familiarization Video Pivotal180

Tax Equity Model with Fixed Flip Date (Generally for Solar Projects

Financial Modeling for Tax Equity Introduction to the Course YouTube

Exercises for Modelling Tax Equity Edward Bodmer Project and

Following Is A List Of Courses Approved By The Department Grouped Alphabetically By Provider And Numerically By Course Number Within The Provider.

Develop Best Practice Techniques In Order To Calculate And Analyse Returns At.

This Is An Intensive Course Providing An Overview Of The Tax Equity Structures Commonly Used In U.s.

The Course Begins With Some Fundamental Modelling With Some Exercises On Creating A Time Based Flip And A Yield.

Related Post: